Admara launches a new 5,000m2 residential project in the Barrio de las Letras

La gestora española Admara Capital aterriza en el paseo de la Castellana, Madrid

La gestora española Admara Capital aterriza en el paseo de la Castellana, Madrid

La gestora española Admara lanza una promoción de pisos de lujo en La Castellana con una inversión total de 25 millones.

La gestora española Admara lanza una promoción de pisos de lujo en La Castellana con una inversión total de 25 millones.

De sede de embajadas, como la de Chipre o Malta, a viviendas de lujo. El centenario edificio, ubicado en el número 45 del madrileño Paseo de La Castellana, se prepara para estrenar nueva vida y sumarse a los exclusivos proyectos de alto standing.

Spanish asset manager Admara Capital invests in the Jerónimos, Madrid

Spanish asset manager Admara Capital invests in the Jerónimos, Madrid

Spanish asset manager Admara Capital invests in the Jerónimos, Madrid

BeGrand, allied with the Admara asset manager, has acquired a building from AXA in the Los Jerónimos neighborhood, one of the most elite areas of the capital, to sell apartments for 3.5 millionBeGrand, allied with the Admara asset manager, has acquired a building from AXA in the Los Jerónimos neighborhood, one of the most elite areas of the capital, to sell apartments for 3.5 million

BeGrand, allied with the Admara asset manager, has acquired a building from AXA in the Los Jerónimos neighborhood, one of the most elite areas of the capital, to sell apartments for 3.5 millionBeGrand, allied with the Admara asset manager, has acquired a building from AXA in the Los Jerónimos neighborhood, one of the most elite areas of the capital, to sell apartments for 3.5 million

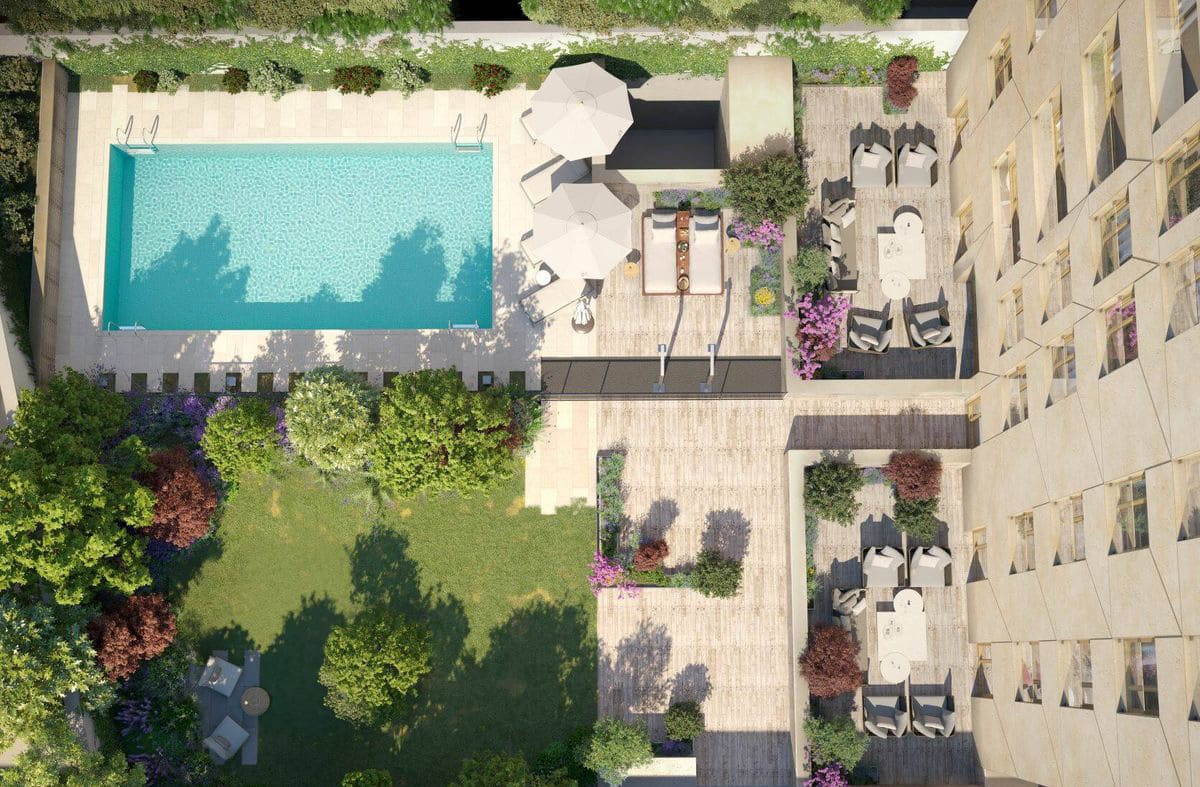

New investment by the Mexican group BeGrand in the heart of Madrid. In partnership with Admara Capital, it has acquired from AXA a residential building located in the Los Jerónimos neighbourhood, one of the most exclusive areas of the capital. It is number 11 on Antonio Maura Street, an artery that connects the Retiro Park and the Stock Exchange Palace, and which is integrated into the Landscape of Light, a cultural environment declared a World Heritage Site.

Admara as a reference in the luxury residential segment in Madrid

Admara as a reference in the luxury residential segment in Madrid

Admara as a reference in the luxury residential segment in Madrid

To infinity and beyond in ultra-luxury: the price is already close to 25,000 euros per square metre in Madrid

To infinity and beyond in ultra-luxury: the price is already close to 25,000 euros per square metre in Madrid

Regardless of the current macroeconomic environment, sales prices in luxury residential continue to rise in the segment that experts call ‘ultra high-end’.

Changes in use

Changes in use

Changes in use

Grupo Lar, Acciona, the joint venture between Admara and the Mexican company Be Grand, the Capriles family and Persepolis are some of the investors seeking profitability in the business of converting offices into homes.

Grupo Lar, Acciona, the joint venture between Admara and the Mexican company Be Grand, the Capriles family and Persepolis are some of the investors seeking profitability in the business of converting offices into homes.

The investor frenzy for the residential business in Spain, together with the lack of suitable land in the most in-demand areas of the major capitals, forces capital to opt for other alternatives to promote housing without losing profitability…

Luxury housing in the Literary Quarter

Luxury housing in the Literary Quarter

Luxury housing in the Literary Quarter

The Mexican real estate company Be Grand, in alliance with the local property manager Admara, is raising the bid for the high-end residential complex in Madrid.

The Mexican real estate company Be Grand, in alliance with the local property manager Admara, is raising the bid for the high-end residential complex in Madrid.

The investor’s bet on luxury residential comes to the Las Letras neighbourhood. The joint venture formed by the Mexicans Be Grand and the Spanish asset manager Admara buys an office building to transform into housing from a group of investors, including footballers, led by Paul Gomero.

Admara closes a new operation in Almagro with Begrand and Rockstone

Admara closes a new operation in Almagro with Begrand and Rockstone

Rockstone Real Estate’s second operation in Spain has been the purchase of number 42 Santa Engracia, in the sought-after Madrid district of Chamberí. This acquisition has been closed together with the Mexican companies Be Grand and Admara.

BeGrand (the Mexican giant developer) lands in the Salamanca district with the help of Admara Capital

BeGrand (the Mexican giant developer) lands in the Salamanca district with the help of Admara Capital

A group of Mexican investors (Begrand) and La Finca, under the umbrella of the management company Admara Capital, have bought Padilla 66, a residential project of 25 luxury apartments.

The new owners of the building will maintain the project, which includes the construction of 25 luxury apartments, although they will improve the quality of the apartments with respect to the original project. Although the amount of the transaction is unknown, according to several market sources, the total investment —including the purchase of the building and the construction— amounts to 25 million euros. The operation has been advised by TC Gabinete Inmobiliario.

La Finca professionalizes its board with executive profiles

La Finca professionalizes its board with executive profiles

Specifically, the company has appointed Andrés Benito as a director of La Finca Global Asset, the office Socimi also owned by Värde (40%) and listed on the MAB.

Benito, general manager of Admara Capital – a real estate management company owned by Grupo La Finca – replaces Francisco Peñalver Sánchez, a long-standing capital partner of the company.

Admara Capital brings together Rockstone and LaFinca as investors for a luxury residential project in the centre of Madrid

Admara Capital brings together Rockstone and LaFinca as investors for a luxury residential project in the centre of Madrid

The Rockstone fund lands in Spain. It is a firm created by a German family office that, since its creation, has achieved a portfolio valued at 500 million euros. Its intention in the short term is to double this figure.

The German fund Rockstone Real Estate has created a joint venture with the La Finca Group, called Rockstone Admara Capital Ibérica, to develop luxury projects in the center of Madrid.

Its first project will be Virgen de los Peligros 9. It is a building very close to Centro Canalejas, between Calle Alcalá and Calle Gran Vía, which will be fully renovated. Once the renovation is finished, the homes will be sold individually, for over one million euros, raising the valuation of the project to over 20 million. The new homes can be delivered in the second quarter of 2023.

The operation has been advised by the law firms Pinsent Manson and Roca Junyent. The asset will be managed by the management and investment platform Admara Capital.

The Spanish asset manager Admara is one of the most active players in the purchase of buildings in Madrid

The Spanish asset manager Admara is one of the most active players in the purchase of buildings in Madrid

The Spanish asset manager Admara is one of the most active players in the purchase of buildings in Madrid

Funds and family offices double the bidding for luxury apartments in Madrid

Funds and family offices double the bidding for luxury apartments in Madrid

‘BOOM’ INVESTOR/ With capital from funds and family offices, Besant, Blasson, Impar, Ardian, Grupo Lar and Admara are spending more than 500 million to buy offices to convert into high-end housing.